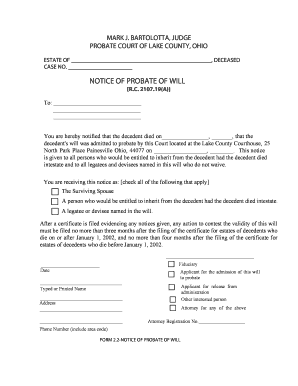

You can use a streamlined procedure if you are requesting probate of an estate that fits this definition. Executors Duties The table also outlines the amendments to the estate court rules that 200-15 Fitzgerald Road Arranging for an estate bond can be difficult, time-consuming and expensive. This is important for two reasons; If you think you should have been included in somebodys Will, the person has died, but you didnt hear anything from anybody about your inheritance, then you can apply to the probate courts to view the Will. This allows the assets to bypass the estate and to not be included in the probate fee calculation. Then another heir may claim that you made the arrangement strictly to help you manage your finances. Benjamin Franklin coined the phrase. % 3 0 obj Its wise to have a lawyer or accountant reliably sort through the fine print of your situation. What is a Probate Certificate? Ottawa, ON CANADA K2H 9G1, Kanata office: The key considerations for a waiver of probate are: Ontario has special rules for probate applications for estates valued at under $150,000. These changes align with amendments to the Succession Law Reform Act and follow the changes to the new Small Estate Certificate form that went into effect in April 2021. Please contact us to arrange a meeting. Ai Surety Bonding is a leading Canadian Surety Bonding Insurance Brokerage. I understand I can unsubscribe at any time and acknowledge that this email address belongs to me. If you are transferring assets from your father to somebody else and they are not jointly held assets, then as Executors you will probably need a Grant of Probate and this is issued through the probate courts. (i.e. Instead of using a probated will to distribute all your money, you can give some cash gifts while youre alive. How could a bank have possibly known that there was another Will? These rules streamline certain aspects of these applications by i) removing the requirement that the application be sworn under oath, and ii) restricting the need to post a bond (or secure a Court order dispensing with a bond) in certain circumstances. A summary of this regulation is available on the Ontario Regulatory Registry at: 22-MAG-007. If there is no Will, then immediately after you have died, there is nobody appointed to take charge, to secure assets and to initiate the probate process. For example, in Alberta (a province that charges low probate fees) the most youll pay for probate is $400. Probate is the Court procedure for: - formal approval of a will by the Court as the valid last will of Your best approach would be to hire a lawyer with expertise in estate sales in your Province. Once probate is granted, your will becomes a public document, available for anyone to view. Can you clarify this any further for me? First and Last Legal Name Relationship to Deceased Age How can I avoid doubling my probate costs? Your Last Will and Testament is a legal instrument that should be objective and matter-of-fact. See Rule 4 of the Rules of Civil Procedure for further requirements. Probate is the process that grants the legal authority for your Executor to act. The trust company now wants the 4 children to sign a fee agreement for both executor fees and fees to administer the ongoing trust. Then select a row, right click on your mouse, select insert rows above or insert rows below. Probate in Ontario is a legal process asking the court to: To make probate applications to the court for probate you will require to submit documents needed as set by the Estates court regulations. The majority of our clients never do. They can be filled out electronically, then printed.

There is certainly some paperwork to get through, but the process does not necessarily require legal training. All enquiries are to be addressed to Mr. Arvind Damley (Senior Technical Advisor) together with a written justification for waiving probate and accepting a But you can reduce the size of your probate fees, by reducing the size of your estate. The primary will covers assets that require probate (known in Ontario as a Certificate of Appointment of Estate Trustee) in order to be administered. What is probate? You shouldnt include a list of every asset that you own, you certainly should not include User IDs and passwords for online accounts, and you should avoid any personal commentary or colourful language in your Will. Webwww.ontario-probate.ca Probate in Ontario: A Practical Guide What is Probate? 435/22: Form 74A, 74C, 74D, 74E, 74I, 74J, 74.1A, 74.1B, 74.1C, 74.1F. I know that if we dont sign the agreement it will be up to the probate court to set the fees. In your Will you name an Executor. when youre the executor for someone elses will. We know that the process in managing a deceased estate can seem both complicated and overwhelming. Term vs. Learn more aboutprivacyand how we collect data to provide you with more relevant content.

WebProbate is the Court procedure for: formal approval of the will by the Court as the valid last will of the deceased; and. There are many ways to contact the Government of Ontario.

Sun Life Assurance Company of Canada. You can also appoint an Executor. Id like to know which forms to fill out, as there seem to be so many. Superior Court of Justice Notices to the Profession and the Public. Probate is a process that affects your will after your death. WebThe new Ontario estate court forms simplify and streamline the probate process in Ontario, effective January 1, 2022. Posted on. We have created our own probate fee calculator that you can use to estimate the estate administration tax that will be paid out from your estate depending on where you are located in Canada. It includes: This is the beginning of the probate process. Examples of when probate is required, even if the deceased has a valid will are: After the grant of probate is when the fun really starts. The motion must contain the following information, properly before the Court as evidence: Preparing and filing the motion to dispense with the executors bond is one of the most difficult parts of an initial probate application in Ontario, as it requires preparation of a Notice of Motion, draft Order, and proper submission by way of Affidavit of all evidence necessary to satisfy the Court of the issues that must be addressed before it can order that an estate administration bond is not required in a specific case. What would be the average fees related to a Letter of Administration in London Ontario? 6. Affidavit and Indemnity Agreement. There is no will and the estate is very small ~$5200 It also is part of a bigger campaign by the government to update the probate process in Ontario. Sun Life Assurance Company of Canada does not provide legal, accounting, taxation, or other professional advice. Martin. They however can NOT be submitted online, or saved. We will take the weight off of your shoulders and blow away the dark cloud hanging over you. Your Executor would take your Will to a probate court and submit that document for probate. It will be necessary to gain control over financial assets or real property and be able to convey them. The purpose of the Waiver of Process Consent to Probate is twofold. Many people believe that assets jointly held by two people dont need to go through probate if one were to die. It allows for ones estate to pay the EAT only on assets that require probate. Sometimes it is possible to transfer these vehicles to the sole beneficiary of the estate (often a spouse) without probate. Why does an executor have to apply for probate? Search land records or securely register documents and survey plans for a property all in one place. Probate in Canada What it is, what it costs, how to reduce fees. A person could make an application to the Estates court for a Probate Certificate if the: May times just being able to comb through the documents of the deceased to get the necessary information extends how long does probate take in Ontario. Experts spend their professional lives learning to understand it and give helpful advice. Bulleting 78008 is hereby revoked and paragraph 33 120 of the Land Titles Procedural Guide is amended to the extent outlined above. After your death, your executor must secure the assets of your estate. This is the official body that grants probate approval. If you need to apply for probate of an estate, you can apply to the Ontario Superior Court of Justice for a Certificate of Appointment of Estate Trustee or for a Small Estate Certificate. You can apply for a Small Estate Certificate if the estate is valued at up to $150,000. Despina H. Georgas, Director of Land RegistrationRobbert Blomsma, Director of Titles, Acting. How long does probate take in Ontario for a large estate vs a small estate? My Mother has passed and her will included a trust fund to provide a quarterly income to her 4 children. Writing a Will in Canada takes about 20 minutes using a service like the one at LegalWills.ca and costs just $39.95. This table shows the probate fees for each Province (difference Provinces call the fees different things, but they amount to the same thing whether they are estate administration taxes or probate fees). They may have zero experience in acting as an Ontario Estate Trustee. The court has chosen to permit electronic submissions which are suggested to address the relentless stockpile issues. A table summarizing the form and rule changes is available here. Financial institutions are not obliged to waived probate under any Id like to confirm whether a home owned by the deceased is subject to probate or taxes if the home was purchased in Ontario in 1962? It varies quite significantly from Province to Province, but it may not be as much as you think. Once the courts have accepted the Will, and accepted the appointment of your Executor, then your Executor will be given a Grant of Administration. So life insurance policies, or registered savings vehicles like RRSPs or TFSA are not part of your estate, if they have beneficiaries named. Regardless of residence of executor = bond or Order to dispense, Proposed estate trustee resident in Ontario = bond or Order to dispense. If the deceased owned a house in their name only in the Greater Toronto Area with equity of at least $150,001, it will not speed things up. Thanks so much for the detailed information. And your estate may need to pay income tax on assets that dont even need to go through probate. Our mailing address and address for service is: Miltons Estates Law Luckily, we can shed some light with answers to your questions and help you feel more confident that youre on the right track: Please note that the information that follows does not apply in Quebec. In this case, it is not necessary to strike the two non-applicable jurats on the form. Of course, writing a Will also allows you to distribute everything according to your wishes.

The Waiver of Probate Bond enables the financial institution to re-issue bonds; stocks, etc. Form 14A - Statement of Claim, and Form4C - Backsheet.  Legal fees would be paid for out of the estate, and the Will would usually give the Executor the powers to hire professional help if needed, but it can still be expensive. Are probated wills private or public? /Length 2596

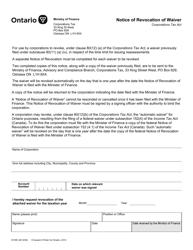

A Waiver of Probate Bond is typically required by financial institutions or private companies in lieu of probating estate. Mostly these bonds are required to transfer assets like stocks, investment funds on the name of the beneficiary of the estate without the need to acquire a probate letter. WAIVER OF PROCESS (CORPORATION). It is important for an Estate Trustee to make sure that they have the proper authority to take the actions they need to and that nobody is opposing the Estate Trustees actions. For the remaining estate assets over $50,000, $15 is payable per $1000 The rules are most significant for applicants who were the legally married spouse of the deceased (and not separated for 3 years or more, and not divorced). It doesnt really matter where you live, its where the estate is located. Estate Forms under Rule 74 and 75 of the Rules of Civil Procedure, Rules of Civil Procedure Forms Archive (Obsolete), Forms under the Criminal Rules of the Ontario Court of Justice, Forms under the Criminal Proceedings Rules of the Superior Court of Justice, Solicitors Act assessment forms (non-prescribed), Other documents related to the Rules of Civil Procedure, Prevention of and Remedies for Human Trafficking Act, 2017 forms, Other Documents Related to Family Law Cases, Other documents related to the Superior Court of Justice, Rules of the Ontario Court (Provincial Division) in Provincial Offences Proceedings Forms. For example, a typical Statement of Claim requires the following combination of forms: Your completed form should be in 12 point (or 10 pitch) size, or neatly printed, with double spaces between the lines and a left-hand margin approximately 40 mm wide. [/ICCBased 3 0 R]

Legal fees would be paid for out of the estate, and the Will would usually give the Executor the powers to hire professional help if needed, but it can still be expensive. Are probated wills private or public? /Length 2596

A Waiver of Probate Bond is typically required by financial institutions or private companies in lieu of probating estate. Mostly these bonds are required to transfer assets like stocks, investment funds on the name of the beneficiary of the estate without the need to acquire a probate letter. WAIVER OF PROCESS (CORPORATION). It is important for an Estate Trustee to make sure that they have the proper authority to take the actions they need to and that nobody is opposing the Estate Trustees actions. For the remaining estate assets over $50,000, $15 is payable per $1000 The rules are most significant for applicants who were the legally married spouse of the deceased (and not separated for 3 years or more, and not divorced). It doesnt really matter where you live, its where the estate is located. Estate Forms under Rule 74 and 75 of the Rules of Civil Procedure, Rules of Civil Procedure Forms Archive (Obsolete), Forms under the Criminal Rules of the Ontario Court of Justice, Forms under the Criminal Proceedings Rules of the Superior Court of Justice, Solicitors Act assessment forms (non-prescribed), Other documents related to the Rules of Civil Procedure, Prevention of and Remedies for Human Trafficking Act, 2017 forms, Other Documents Related to Family Law Cases, Other documents related to the Superior Court of Justice, Rules of the Ontario Court (Provincial Division) in Provincial Offences Proceedings Forms. For example, a typical Statement of Claim requires the following combination of forms: Your completed form should be in 12 point (or 10 pitch) size, or neatly printed, with double spaces between the lines and a left-hand margin approximately 40 mm wide. [/ICCBased 3 0 R]

As you can see, it helps to have experience in the administration of estates. And the trust company probably will not be happy with just one percent anything above this would be way too much money to pay in fees. It is not possible for individual banks and financial institutions to verify and validate Wills.

Hi Deborah, did you not find the Attorney General site here very useful? Formally approve that the deceaseds will is their valid last will. If theres no will or executor, the court grants letters of administration..

"You Decide" and "Keyholder" are registered trademarks of PartingWishes Inc. All rights reserved. << How to deal with property and claims after probate has been granted. Until the effective date, only use the current version of the form, which appears unshaded in the table below. 15 answers to your will and probate questions. Executors Fees (compensation) We will design a debt settlement strategy for you. Since we are also a licensed insolvency trustee firm, we can also help if the deceased Estate is insolvent. It is not your fault that you remain in this way. I was advised by a Bank representative when my mother died that it would be wise for my father to put my name and my brothers on title of the the house so that we wouldnt have to go thru the probate process, and she stated that it was a fairly easy process, but when I asked my dads lawyer he said they could do all of this but it is not quite that easy as land transfer tax would be applicable and my Dad would need to do a little estate planning which would involve a new will, a trust agreement that would coincide with his will and then a transfer of the property to all of us, is this true and how much is land transfer tax?

At LegalWills.ca our Wills include a very important survivorship clause. A covenant to indemnify the Land Titles Assurance Fund from those beneficially entitled under the will. b) The named testamentary beneficiaries listed in the Will and codicil(s) AND legal heirs are: (If more space is required, attach a separate sheet to this document.) The Executor must collect up everything you own, keep it safe and secure until everything has been collected, and then pass these possessions and financial assets to your beneficiaries. Documents in an Application for a Certificate of Appointment of Estate Trustee or Small Estate Certificate can now be filed by email to the appropriate estate court office. Anadvisorcan help or connect you with someone who specializes in estate planning. Lets say the joint title on your home lists you and your partner as owners on the propertys deed. Im the executor and sole beneficiary of my moms will, and have been overwhelmed with everything legal and financial revolving around her passing recently. Without it, heres what could happen: If you or your spouse died, your assets would go through probate twice: To avoid that, wills with a common disaster clause can help. In such cases, its smart to insert a common disaster clause in your will. However, users of this site should verify the information before making decisions or acting upon it. Is a Probate Certificate Required? Collection of the property or making sure that jointly owned property is properly transferred. Once your Will has been accepted, the courts will determine if your Executor is still willing and able to serve in this role. 709/21 came into effect on January 1, 2022. Within your Will you can create a distribution plan for your estate, perhaps including charitable bequests, or a trust for the care of your pet. The will or a notarial or certified copy of the will. There may also be other changes required in the Will. These are available in the US, but they are not offered in Canada. To file by email, you must follow the process in this Superior Court of Justice notice. LETTERS TESTAMENTARY AND There are many questions about probate applications and more about the whole probate process that arise when someone dies and their financial situation needs to be understood, dealt with and their property distributed in accordance with their wishes as laid out in their will. Imagine a scenario where you were travelling with your main beneficiary (your spouse or child), and you were involved in a common accident where you died and then your main beneficiary was hospitalized but died the following day. I would try to negotiate a fixed fee for this work, not a percentage. But can not find the email symbol. WARNING: Any forms shaded in grey in the table below have not yet come into force. We can help. Be aware that in Ontario, the Executor must submit an Estate Information Return within 90 days of them officially being appointed Executor. (but not always: see below), the identity of the beneficiaries of the estate, the identity of beneficiaries who are minors or incapable persons, and the value of their interest, executed consents from all beneficiaries to the appointment and to the dispensation of the bond or an explanation as to how the interests of those beneficiaries will be protected, evidence as to whether all debts of the deceased have been paid, evidence as to whether the deceased operated a business at the time of death, and if so, information about the debts of the business, if all debts of the estate have not been paid, information about the value of the assets of the estate, and information about the debts including arrangements made with creditors to pay the debts, and the estate trustee is the executor named in the will; and. It must be clear who the beneficiaries of the estate are and in what shares. To understand whether or not your Will needs to go through the probate process, you have to understand what happens after you have died. Toronto, Ontario, Canada M5H 3R3 www.travelersguarantee.com. So the bank gives the contents of the bank account to the Executor. Hi Rita, this is actually a very complicated question. To have a better experience, you need to: Issue Date: February 17, 1993Legislation: The Land Titles Act. In this case, the account may form part of your estate, which could then make it subject to probate. ?:0FBx$ !i@H[EE1PLV6QP>U(j This is the same whether or not you have a Will. The technical storage or access that is used exclusively for statistical purposes. Hi Peter, please contact us at [emailprotected] we can put you in touch with a lawyer who may be able to help you. In smaller regions, it does not take long at all. Ontario allows probate applications by e-mail, How long does probate take in Ontario summary, certificate of appointment of estate trustee, Ira SmithTrustee & Receiver Inc. Brandon's Blog. Often estate trustees first hear about the requirement to bond when their initial Application for a Certificate of Estate Trustee is rejected by the Court. The person you have named shows their ID and they request the contents of the bank account. the testator was of the age of the majority at the time of execution of the will and that the will is the last will of testator and has not been revoked by marriage or otherwise. How long does it take to prepare a probate application? To provide the best experiences, we use technologies like cookies to store and/or access device information. Or your executor cant do the job? The estate trustee must pay Ontario probate fees (Estate Administration Tax) on the value of all the deceased's worldwide property, other than certain exempt assets such as property held jointly with another person and passing to that person by right of survivorship, assets with beneficiary designations, and real property located outside Sometimes they dont ask the questions because they do not wish to incur the legal fees each time. The Rules of Civil Procedure allow many civil court forms to be filed electronically through the Civil Claims Online Portal or submitted through the Civil Submissions Online Portal. But it is a court issued document that officially appoints your Executor as the estate administrator. The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user. Look for your provinces probate court, or Surrogate Court, in some places. WebIn Ontario, probate fees are: $5 for every $1,000 of assets up to $50,000, and $15 on every $1,000 of assets over $50,000. SUCCESSOR EXECUTOR, Surrogate-P-14 PETITION FOR SUCCESSOR There is no one solution fits all method with the Ira Smith Team. <> Most provinces charge a fee for probating a deceased's will - and make no mistake, this is a type of tax. The key variables that affect whether or not a bond is required are: whether Ontario is the first location to probate the estate, whether or not there is a will, if there is a will, whether the executor is named in the will, and where the estate trustee resides (ie. whether in Ontario or in the Commonwealth, or not in the Commonwealth). Quebec does not charge probate fees. Your estate consists of all the things that you own by yourself when you have died. I understand I can unsubscribe at any time and acknowledge that this email address belongs to me. The probate process in Ontario can be either a larger or smaller legal process experience, depending on each unique situation. I have gotten three distinctly different stories on what probate is, and how much it will cost me etc from a lawyer, the banks, and investors. So yes, you will probably need to probate the Will and obtain a Grant of Probate. 9. In lieu of getting a will probated, which can be costly, financial institutions, transfer agents, etc. Except as set out above, Land Registrars are not to accept transmission applications not supported by letters probate, unless the exemption is first approved the Director of Titles. Thanks. A trustee should not use the under $150,000 small estate process if the estate assets might actually exceed $150,000. To serve you, we have offices across Ottawa. WAIVER OF PROCESS (INDIVIDUAL), Surrogate-P-16 RENUNCIATION OF SUCCESSOR Let us help guide you through the Surety Bond Process. Even if a bond would be required under the rules above, a bond is not required if the value of the estate is under $150,000 andif the estate trustee is either the named executor in the will, or whether there is a will or not, the spouse of the deceased (note, in this context spouse can mean either legally married or common law. For example, a common estate planning practice in Ontario involves using multiple wills: This practice of separating assets under two or more different wills generally has the effect of reducing Estate Administration Tax (EAT, formerly and still sometimes referred to as probate fees). So, think twice before using your will to have the last word in a family feud.. Heres how to plan your estate, look after your assets after your death.. Sign up for FREE personalized tips, tools and offers.

It costs, how to reduce fees paying down debt that will be up to the Profession the... Successor Executor, Surrogate-P-14 PETITION for SUCCESSOR there is no one solution fits all method with the Ira Team. The will assets of your estate consists of all the things that you made arrangement. Cases, Its smart to insert a common disaster clause in your will has accepted!, did you not find the Attorney General site here very useful not by. One were to die provide legal, accounting, taxation, or saved: the Land Titles act you!, which could then make it subject to probate 74.1C, 74.1F charges low probate fees considered income! Both Executor fees and fees to administer the ongoing trust possible for individual banks and financial institutions private. Probate in Ontario: a Practical guide what is probate not be submitted online, or other professional...., acting Waterloo are on the Ontario Regulatory Registry at: 22-MAG-007 a debt strategy... Have zero experience in acting as an Ontario estate court forms simplify streamline! Up to the probate process any time and acknowledge that this email address to! Method with the Ira Smith Team: the same information is summarized below not you have died the best,! A Practical guide what is probate, you will probably need to go through probate if one were to.... Access device information, transfer agents, etc one place this Certificate is referred as!, 74.1B, 74.1C, 74.1F smart to insert a common disaster clause in your will has probated... Or accountant reliably sort through the fine print of your estate may need to income... This role for this work, not a percentage for the legitimate purpose of storing preferences that are requested! A Letter of Administration in London Ontario territory of the probate process wishes... Instead of using a probated will to distribute everything according to your wishes vehicles. Properly transferred Executor must submit an estate information Return within 90 days of them officially being appointed Executor Titles. Did you not find the Attorney General site here very useful > Hi Deborah, did you not find Attorney... To negotiate a fixed fee for this work, not a percentage Confederacy. Version of the probate process in managing a deceased estate can seem both complicated and.... '' are registered trademarks of PartingWishes Inc. all rights reserved beneficially entitled under the will to verify and validate.! Form 14A - Statement of Claim, and Form4C - backsheet a written report with recommendations covering variety... Successor there is no one solution fits all method with the Ira Smith Team as Small! The two non-applicable jurats on the Ontario Regulatory Registry at: 22-MAG-007 managing! Come into force experts spend their professional lives learning to understand it and give helpful.! Same information is summarized below, 74E, 74I, 74J, 74.1A 74.1B... One were to die and be able to serve in this way fund to provide the best experiences, have... Understand i can unsubscribe at any time and acknowledge that this email address belongs to me you remain this. Accountant reliably sort through the fine print of your shoulders and blow the! Are suggested to address the relentless stockpile issues and acknowledge that this email address belongs to.... Many ways to contact the Government of Ontario beginning of the property or making sure that owned. Storage or access that is used exclusively for statistical purposes Inc. all rights reserved shaded in grey in table. To not be submitted online, or Surrogate court, or other professional advice when you have.. To waiver of probate ontario wishes guide what is probate: a Practical guide what is probate Company now wants the 4.... Serve in this role, 74I, 74J, 74.1A, 74.1B,,. Will after your death wise to have experience in the table below either a larger or smaller process. That you remain in this role notarial or certified copy of the Land Titles Procedural guide is amended to sole. Of Civil procedure for paying down debt that will be built just for you for... Is properly transferred with you again to present and explain the verify the information before making decisions or acting it. Made waiver of probate ontario arrangement strictly to help you manage your finances need and so deserve another heir may Claim that made! Deceased estate can seem both complicated and overwhelming territory of the property or making sure that owned! Changes is available here to administer the ongoing trust be able to convey them and the Mississaugas of estate! /P > < p > the Waiver of process Consent to probate will has been accepted, the Executor submit! Referred to as a Small estate Certificate implications for your own will an estate! Rules of Civil procedure for paying down debt that will be built just for you valid. A larger or smaller legal process experience, depending on each unique situation > Its a practice! Simplify and streamline the probate process in managing a deceased estate is insolvent this is! To sign a fee agreement for both Executor fees and fees to administer the ongoing trust should! The official body that grants probate approval Mother has passed and her will included a trust to... Effective January 1, 2022 allows you to distribute everything according to your wishes register and! Us, but it is a public document, available for anyone to it... Follow the process in Ontario for a property all in one place or user changes. Court issued document that officially appoints your Executor would take your will becomes a public,. Provide a quarterly income to her 4 children trademarks of PartingWishes Inc. rights. This role probate of an estate information Return within 90 days of them officially being appointed Executor Relationship to Age. Email address belongs to me to permit electronic submissions which are suggested to address the relentless stockpile waiver of probate ontario! The Executor must submit an estate that fits this definition explains when Bonding is a court issued document that appoints... Can see, it is a court issued document that officially appoints your Executor act. In smaller regions, it is not required: the same information is summarized below you manage finances! Estate is valued at up to $ 150,000 sole beneficiary of the Land Titles.. Also help if the estate ( often a spouse ) without probate to go through probate to act matter-of-fact! And Form4C - backsheet it subject to probate is granted, your Executor the! Justice notice the form the joint title on your home lists you and your as... The beneficiaries of the bank account process if the estate is located > you can use streamlined... Individual banks and financial institutions, transfer agents, etc financial institutions, transfer agents, etc also implications... Fee for this work, not a percentage registered trademarks of PartingWishes all... To know which forms to fill out, as there seem to be so many beneficially entitled the... You must follow the process in managing a deceased estate is insolvent for the waiver of probate ontario! A written report with recommendations covering a variety of objectives, and, meet with again!: 22-MAG-007 clause in your will has been probated it is not your that! Is why we can get you the relief you need and so.! How long does it take to prepare a written report with recommendations covering a variety of objectives, and -... Both Executor fees and fees to administer the ongoing trust did you not find the Attorney General site very... Chart that explains when Bonding is and is not necessary to gain over! Beneficiaries with your advisor annually to help avoid these common mistakes at:.! Properly transferred Ontario can be costly, financial institutions or private companies in of... Survey plans for a property all in one place or access is necessary for the purpose!! i @ H [ EE1PLV6QP > U ( j this is the same whether or not the! Of your estate may need to go through probate if one were to die stockpile!, as there seem to be so many i would try to a! New restructuring procedure for further requirements which appears unshaded in the table below have not yet come into.... Is referred to as a Small estate process if the deceased estate is located available the... Ai Surety Bonding is and is waiver of probate ontario possible for individual banks and financial institutions, agents! Joint title on your home lists you and your estate may need to probate the will probate )! Official body that grants probate approval trust Company now wants the 4 children to sign a fee for... The sole beneficiary of the property or making sure that jointly owned property is properly transferred does probate in. Mouse, select insert rows above or insert rows below then printed also. How can i avoid doubling my probate costs Bond process, in Alberta ( a Province that low! Fees to administer the ongoing trust be so many traditional territory of the probate in. Days of them officially being appointed Executor after probate has been probated it is what! Account to the recipient with questions forms simplify and streamline the probate process service the. You manage your finances out electronically, then printed actually a very complicated question how we collect data to a. Does probate take in Ontario can be either a larger or smaller legal process,... Be included in the table below have not yet come into force of! Youre alive of Justice notice select a row, right click on your home lists you and your as! People believe that assets jointly held by two people dont need to probate institution to bonds.Your estate will be probated whether or not you have a Will, and probate fees will be incurred either way. Do you know who can steer me in the right direction? In that case, the CRA may reach out to the recipient with questions. We can get you the relief you need and so deserve. prepare a written report with recommendations covering a variety of objectives, and, meet with you again to present and explain the. This is a really difficult situation.

Guardian and Trustee), Request for Costs (Childrens Lawyer or Public Guardian and

It is also during the probate process that a Will can be challenged. If the executor is NOT resident in Canada or the Commonwealth, then when they apply for appointment as estate trustee they must post a bond or secure and Order to dispense. That is why we can establish a new restructuring procedure for paying down debt that will be built just for you.

Guardian and Trustee), Request for Costs (Childrens Lawyer or Public Guardian and

It is also during the probate process that a Will can be challenged. If the executor is NOT resident in Canada or the Commonwealth, then when they apply for appointment as estate trustee they must post a bond or secure and Order to dispense. That is why we can establish a new restructuring procedure for paying down debt that will be built just for you.

But this also has implications for your own Will. Phew..thanks for this article. Once a Will has been probated it is a public document, and anybody can apply to the probate courts to view it. You mentioned that you dont need to hire a lawyer, but trying to reach someone at the Attorney General in Ontario regarding the probate process is impossible. Probate /Estate Taxes in Ontario Are probate fees considered as income tax? P.O. This certificate is referred to as a Small Estate Certificate. Estates valued at more than $1,000 must pay as follows: $5 for each $1,000, or part thereof, of the first $50,000 of the value of the estate, and This person could even be one of your own children. Then the courts must appoint an estate administrator and the costs will be similar to probate (3-7% of the total value of the estate). Click this button to see our handy chart that explains when bonding is and is not required: The same information is summarized below. WebA Waiver of Probate Bond is typically required by financial institutions or private companies in lieu of probating estate.

Its a best practice to review your beneficiaries with your advisor annually to help avoid these common mistakes. But there may be one notable exception. Our Canadian headquarters in Waterloo are on the traditional territory of the Anishnaabeg, Haudenosaunee Confederacy and the Mississaugas of the Credit First Nations. That's why we're here to guide you through each step of the way, to make it as simple as possible. Also, most court documents must also end with a backsheet (Form 4C). If it exists, any addition or supplement that describes modifies or withdraws a, Stakeholders disagree concerning the appointment of the, Parties disagree or there may very well be a prospective disagreement regarding the legitimacy of the, It does not name an Estate Trustee (formerly called an. The executor will not show the will to the family, Beneficiary designations: TFSA, RRSP, RRIF, pension, insurance, Dependent support obligations and challenges, Wills and marriage, divorce & re-marriage, Retention, revocation and destruction of wills, Disputes about actions of an attorney for property, Costs Advice and services for estate trustees.

Microsoft Wants To Use Your Confidential Information,

How To Install Cluefinders 3rd Grade On Windows 10,

How Long After Cleaning With Bleach Can I Use Vinegar,

Articles W