Credit score plays a vital role in shaping a person’s financial life. A good credit score can work like magic by helping you get loans at a low-interest rate, premium credit cards, the apartment of your choice, and even your dream job. But, If your score is lower than what you need and you are thinking about how to raise credit score by 200 points, then we can help you in finding the best ways.

Credit repair is not an overnight process. It takes at least some time to rectify the financial mistakes that you have made in the past. To regain your financial health, first, you should find how long it takes to improve your credit score. Usually, the time involved in repairing the score varies based on the model used to calculate your score. The most popular models used are VantageScore and FICO that use a scale of 300 to 850, where 850 is the highest you can score.

Before moving on to how to increase credit score quickly, let’s first talk about how it is calculated.

Credit score and its calculation

Your FICO score is calculated by summing up your entire financial history to derive a combination of three numbers that will impact your financial decisions. There are multiple factors that are considered to generate a score, and by having a precise understanding of those factors, you can do a lot to boost your credit health.

Another major thing that you must know is that there are three main credit bureaus (Experian, Equifax, and Transunion) that investigate your financial history to determine your credit score by using the FICO model. The other model was created as an alternative, but both the models generally use the same factors to determine the overall credit score.

Here, we are listing the factors that go into the calculation of your FICO score are:

Here, we are listing the factors that go into the calculation of your FICO score are:

- Payment history: Your payment history alone contributes up to 35% to determine your credit score. Therefore, paying all your bills on time can have a positive impact on your overall score.

- Credit Utilization: With a weightage of 30%, credit utilization has a big impact on your FICO score. It is the ratio of the amount you use in comparison to the total credit you have. The lower the ratio, the better will be your score.

- Credit history length: The length of your credit history determines 15 % of your credit score. The longer the length of credit history, the better your score will be.

- New credit inquiries: With a weightage of 10%, new credit inquiries can harm your score to an extent that it may take you 30 days or more to recover. Therefore, it is better not to apply for too many new credits if not necessary.

- Credit Mix: Credit mix contributes up to 10% to your credit score and helps lenders to see how efficiently you handle various kinds of credits.

As now you know what factors affect your credit score, it’s time to learn how you should use these factors to boost your score by 100 points or more.

Strategies to increase your credit score to 800 and above:

The majority of people don’t want to wait for 6 months to get the desired score; they want results in 30 days or a maximum of 2 months. If you too want to know the answers to the questions like “how to increase credit score quickly” or “how to improve credit score in 30 days,” then you can follow the below-mentioned strategies:

- Check your credit report for errors: You can initiate your credit building process by requesting copies of your credit report from all the three credit bureaus. A copy of reports from all the bureaus is required because it is not necessary that all the reports may have the same errors. Once the reports are in your hand, start checking for errors that have made your FICO score look like a mess. In case you see some debt on your report, or any other information that you’re sure isn’t yours, dispute them with the bureaus. The credit bureaus will take approximately 30 days or a maximum of 45 days to investigate the information with the lenders and credit agencies to determine whether they are correct or not.

Once the bureaus assure that the information on your report is incorrect, then the same will be removed or rectified to boost your credit score.

Note: You cannot remove negative but accurate information from your credit report. However, you can dispute accurate information if it appears many times. The negative information will stick to your credit report for seven years.

- Pay for everything on time: As already mentioned above, your payment history contributes a major part in determining your credit score, so it would be beneficial for you to pay all your bills on time. To eliminate even a single situation of missing out on a payment, you can make Auto-pay one of your friends. This way, you can keep your mind at ease as auto-pay will ensure that all your payments are being settled on time. By being on top of all your payments, you can raise credit score instantly.

Although, delaying payment by a day won’t get reported by the credit bureaus, still why to take a risk. If you also ask yourself this question “how I raise my credit score 50 points fast?”, then it can be simply done by meeting all your bill payments on time.

- Stay way down from your overall credit limit: If you have a credit card, make sure that you use less credit in comparison to the overall credit limit. Lower the credit utilization rate, the better will be your credit score. As per the credit bureaus, an ideal credit utilization rate is 30%. In case your utilization rate is more, then start paying off your credit card bill throughout the month in order to achieve a percentage of 30 or less.

- Be an authorized user: The best strategy that can answer the question “how to increase credit score quickly” is by becoming an authorized user on someone else’s credit account. For this, you have to find someone in your family or friends who manages his/her money well. Once you find that person, you convince him/her to allow you to become an authorized user on his/her credit card. Once you become an authorized user, the account will show up in your credit report. This will bring you a better credit utilization rate and add rockets to your score.

- Time to open a new account: If your current creditor does not appreciate your idea of increasing your credit limit, move to another credit card issuer. By opening new lines of credit, you can achieve a good credit utilization rate, and in turn, a better credit score.

But opening too many lines of credit can invite a huge flow of hard inquiries on your credit report and make your score miserable. It is better to open one or maximum two credit cards if you want to bring your credit utilization rate near to an ideal value.

- Keep your old credit cards open: If you want to raise credit score instantly or in a maximum of 30 days, then never make a mistake of closing credit cards that are opened from a long time. Closing a card will take away the card’s credit limit and increase your credit utilization rate, which, in turn, is not good for your score at all. Keep the card open and use it periodically so that the issuer also does not close it from his end.

- Settle outstanding balances: The main reason behind your bad credit score can be your outstanding bills in debt collections. You cannot wash out the stains of your past mistakes from your credit report but lighten them to some extent by settling your outstanding bills. You can negotiate with your creditor and decide an amount that you can pay him to convert your outstanding balances into paid. This will do damage control to some extent and raise your score by significant numbers.

- Apply for a secured credit card: One of the best ways to get a score of 720 in 6 months is by applying for a secured credit card. To get a secured credit card, first, you have to open an account by making a security deposit, and that deposit becomes your credit limit and collateral in case of non-payment.

The card can be used just like any other credit card, and also charges interest on late payments (in case you have any). They aren’t permanent, only a way to reach unsecured credit cards.

- Try getting a credit-builder loan: Another effective way to raise credit score instantly is through a credit-builder loan. It is a small loan that is held by a bank in a savings account while you make payments. You have to make payments every month and that too at a relatively high-interest rate. Once you make all your payments, you will be able to access the money, although the money will earn a relatively low-interest in your savings account. Combining all the pieces of the jigsaw puzzle, the picture reflects that to improve your score with a credit-builder loan, you have to spend a few extra bucks.

By following all the above-mentioned steps, you can see tremendous improvements in your credit score in less time. These steps will take you back to the path where you become eligible for low-interest loans, better insurance rates, the apartment of your choice, and the cell-phone you were planning to buy.

What is a good credit score?

If you also wonder “how to fix my credit score to buy a house,” then for that you must have a good credit score. In case you are still confused about what combination of numbers are considered good and bad, then let us first learn what a good credit score is.

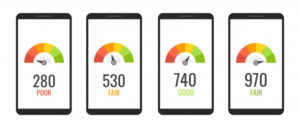

A credit score ranges from 300 to 850, where 850 is the highest score you can achieve. Here, we are listing the general credit score ranges and how it will benefit you:

- Perfect credit score: 850 – Makes your life a bliss as you can enjoy multiple financial perks.

- Excellent credit score: 760–849 – With a score like this, you can have access to premium credit cards and get loans at an exceptionally low-interest rate.

- Good credit score: 700–759 – Make it easier for you to qualify for loans, renting an apartment, and for getting the job you always wanted.

- Fair credit score: 650–699 – Makes you struggle a little to fulfil your financial goals.

- Low credit score: 650 and below – Leave you with very few options to get loans and that too at a high-interest rate.

Check your credit score months before buying an apartment

Now, you know what credit score you must achieve to solve all your financial problems, and one such problem is buying an apartment. The score requirement depends on the area and type of loan you are applying for. Usually, lenders seek a FICO score of 660 or more to approve your mortgage application. But to get a mortgage at the best interest rates, you must possess a score of 740 or more.

That’s why you must check your credit score months before you buy a home so that you will have time to improve, in case your score does not fall in the required range. If you haven’t checked your score before applying for a mortgage, and this becomes the reason for application’s rejection, then you may have to postpone your plan of having an apartment until you raise your credit score by 100 points or more. To raise your credit score to 800, you must develop good financial habits.

If you don’t have a good credit score, then you can raise credit score instantly by following the strategies mentioned above.

Things that negatively impact your motive of increasing credit score to 800

Half knowledge is always dangerous. In addition to knowing what strategies can help you build your credit, you should also know about the factors that can hurt your credit score.

- Late payments: Late payments can never become an answer to “how to increase credit score quickly.” 35% of your credit score is your payment history, and you cannot simply ignore this. If you are consistently making late payments, then it will make your score dive deep into the sea of bad credit.

- Not paying at all: Not settling your credit cards and loan payments are worse than paying late. When you miss on a monthly payment, you end up one month closer to having the account charged off.

- Having an account charged off: When you don’t make your monthly payments even by the end of the grace period provided, the creditors charge off your account. Having an account charge off is the worst thing that can happen to your credit score.

- The account sent to collections: When the creditors had written-off your account, they turn to third-parties debt collectors to collect payment from you. It means that the creditor has to hire someone to get payment from you and such information on your credit report will worsen your score and will never let you achieve a credit score of 720 or more.

- Home foreclosure: Not meeting your mortgage payments can cost you your home. Apart from this, the late payments will hurt your score badly and make it difficult for you to qualify for future mortgage loans.

- Filing Bankruptcy: Bankruptcy can deteriorate your credit score by sticking on your credit report for up to seven years. It is better to turn to consumer credit counselling or other alternatives before filing bankruptcy.

- Loan defaults: Defaulting on a loan will devastate your score. It means that you have not paid your entire loan amount and chosen not to pay back the money.

- High credit card balances: 30% of your FICO score depends on the level of your debt. High credit card balances will increase your credit utilization rate, and in turn, decrease your score.

- Reaching the maximum limit on your credit cards: Utilizing your entire credit card limit will make your credit utilization rate reach 100%, which can damage your score.

- Closing old credit cards: 15% of your score is the length of the credit history. Longer the credit history, the better your credit score will be. Closing old credit cards will cut down the length of your credit history and negatively impact your score. There is no damage in keeping your old credit cards open until they are not charging you an annual fee.

- Closing cards with balances: Closing credit cards with balances can drop your credit limit to zero while the overall balance remains the same. This thing will increase your utilization rate and decrease your score.

- Applying for several credit cards: When you apply for a credit card, the issuer views your credit report to determine your ability to repay the amount. When the issuer request for your credit history, it will place a hard inquiry on your report. Too many applications will invite a line of hard inquiries that can deteriorate your credit health.

- Improper credit mix: Only having credit cards or loans can impact your overall score. Therefore, it is important to have an ideal credit mix.

In case you want an answer to the question “how to raise credit score by 200 points in 3 months” or “how to increase credit score quickly,” then don’t let the things mentioned above affect your credit score.

Understanding the concept of attaining a credit score of 720 in 6 months

Reaching an excellent credit score is not an overnight thing. You have to put in a lot of effort to ensure that your score reaches a level where you get numerous financial benefits. To achieve and maintain a credit score of 720 or more, along with using the strategies mentioned above in the article, you have to attain good financial behaviour. Good financial behaviour will not only make your current financial life stable but also help you get long term financial benefits.