Your credit score is a numerical representation of your statistical likelihood to repay credit that is extended to you. Mortgage Scores range from 300-850. Your score is a “snapshot” of a specific moment and can change with new actions and the passage of time.

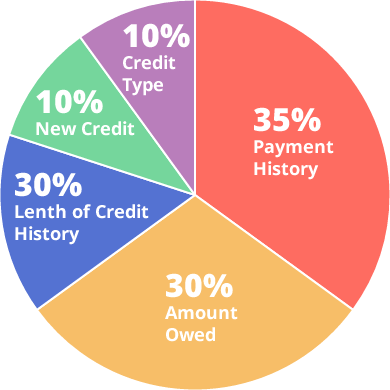

FICO Scores are calculated from different data that can be grouped into five categories as outlined below. The percentages in the chart reflect how important each of the categories is in determining your FICO score.

35% Payment History

Do you pay your credit on time?

Length of positive credit history

Severity of quantity of delinquencies

30% Amount Owed

Too many credit cards with balances can lower your credit score

15% Length of Credit History

The longer the history, the better.

How long have your credit accounts been established?

How long has it been since you used certain accounts?

10% New Credit

Research shows that opening several credit accounts in a short period of time does represent greater risk — especially for people who do not have a long established credit history.

10% Type of Credit in Use (Healthy Mix)

2 installment loans

3 revolving accounts with balances

Balances on revolving debt below 30% of the high credit

Following items have negative effects on your credit score

Collection Accounts

Public Records

Foreclosures

Late Payments