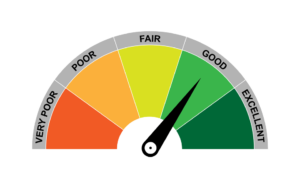

If you have a mission to improve your credit score in 6 months, then you have landed on the right page. Many financial experts would tell you that it is near to impossible to boost your credit score from awful to fantastic in just six months. But by following some simple actions and making some changes in your financial behaviour, you can surely improve your score in a few months. So, before telling you how to improve your credit score, let us first tell you about which range of scores are considered good and bad:

- 300 – 629 → Bad

- 630 – 689 → Fair

- 690 – 719 → Good

- 720 – 850 → Excellent

Now, you can set a target to what extent you want to boost your credit score to make your financial standing strong in the market. To provide you a helping hand, we are sharing some of the most useful tips that you can use to recharge your credit score:

- First, know where you stand: As per a report from the Federal Trade Commission, around 5% of people have errors in their reports that deteriorate their credit health so badly that they find it difficult to get premium credit cards and loans at low-interest rates.

Therefore, before starting on anything, get an accurate picture of your credit score by requesting a copy of your credit report from all the three main credit bureaus (Equifax, Experian, and Transunion) for identifying errors. In case you find some, file a dispute asap to rectify or remove them from your credit report.

- Settle all your bills on time: This is one thing that you can easily do to fix your score. Paying all your bills on the agreed time can positively impact your score. Make sure that in the duration of the next six months, you do not make any late payment. Your payment history is a critical factor that affects your credit score as it alone accounts for 35% of your score.

- Maintain ideal credit utilization rate: If your credit utilization rate is 30% or less, then you have come within the boundaries of a healthy credit utilization rate that add rockets to your credit score. The lower the utilization rate, the better will be the score. But let us clear one thing that even a 0% utilization rate can have a negative impact on your score. As per a report, people having a 0% credit utilization rate have a bad credit score as compared to the ones with 1– 20% utilization.

If you have a very low utilization rate, then you can ask for a credit limit increase that will provide you with more available credit to improve your credit score.

- Avoid applying for new credits: Applying for a new line of credit opens the door for hard enquires that can deteriorate your credit score. If you want to fix your credit score in six months, then you have to stop applying for new credit.

- Review the length of your credit history: The more lengthy and managed your credit history will be, the better will be your credit score. Make sure that your credit report has those accounts that have been open for a longer duration of time and are maintained accurately from their initial stage. Review your credit report and close those accounts that have been opened recently and are not in use.

- Credit Portfolio: Another best way to add some numbers to your credit score is by precisely managing the type and number of accounts that you have opened. Close the accounts that are not in use or will not be used to boost your credit score.

Building a good credit score is not as easy as it seems. To maintain a good credit score, in the long run, you must put in extra effort and follow the tips mentioned above. The better your score will be, the better will be your creditworthiness in the market.